UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 90549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | [X] |

| Filed by a Party other than the Registrant | [ ] |

| Check the appropriate box: | |

| [ | Preliminary Proxy Statement |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a–6(e)(2)) |

| [ | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under Rule 14a-12 |

ADVAXIS, INC.Advaxis, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction. | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials: | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Advaxis, Inc.305 College Road East9 Deer Park Drive, Suite K-1Princeton, New Jersey 08540Monmouth Junction, NJ 08852

NOTICE OF 20192021 ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that the 20192021 Annual Meeting of Stockholders of Advaxis, Inc. will be held at the offices of Goodwin Procter LLP, The New York Times Building, 620 Eighth Avenue, New York, New York 10018, on February 21, 2019,June 3, 2021, at 10:00 a.m., Eastern Time to consider and actwill be held for the purpose of considering and voting upon the following:following proposals:

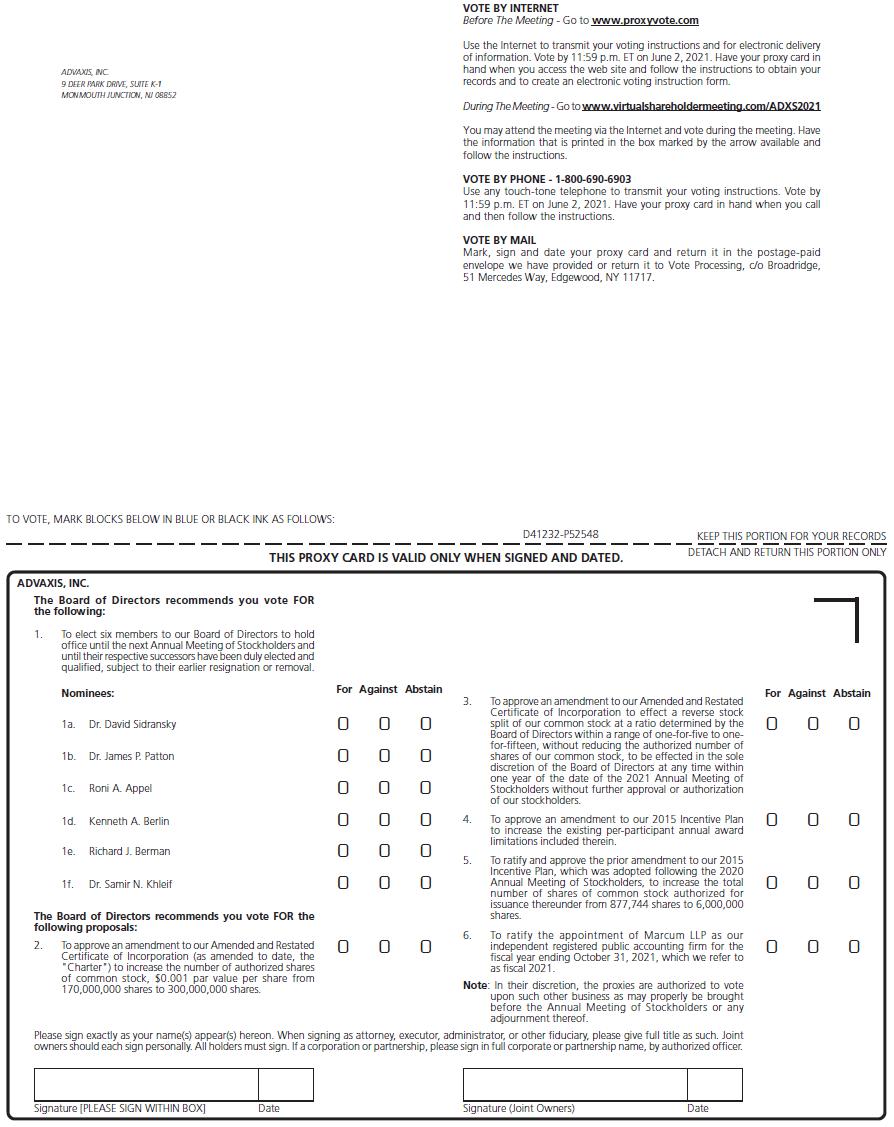

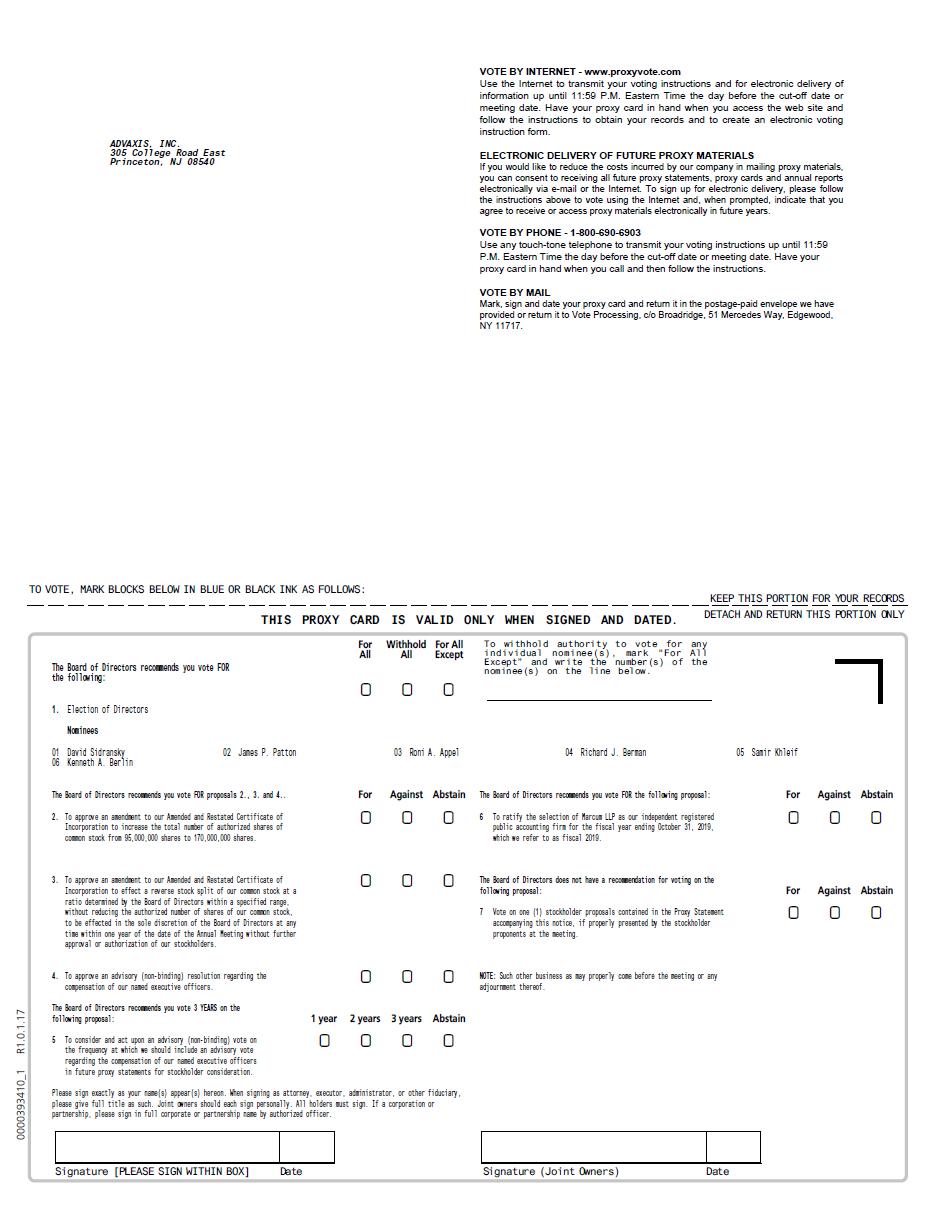

| 1. | To elect six members to our Board of Directors to hold office until the next annual meeting of stockholders and until their respective successors have been duly elected and qualified, subject to their earlier resignation or removal. | |

| 2. | To approve an amendment to our Amended and Restated Certificate of Incorporation (as amended to date, the “Charter”) to increase the | |

| 3. | To approve an amendment to | |

| 4. | To approve an | |

| 5. | To | |

| 6. | To ratify the | |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Our Proxy Statement, Form 10-K/A and annual report to stockholders for the fiscal year ended October 31, 20182020 can also be viewed online by following the instructions listed on our proxy card.

Instructions on howDue to vote your shares viaconcerns relating to the Internet are contained oncoronavirus (COVID-19) pandemic, and to support the “Important Notice Regarding the Availability of Proxy Materials,” which is expected to be mailed on or about January 15, 2019. Instructions on how to obtain a paper copyhealth and well-being of our Proxy Statementemployees and annual report to stockholders forshareholders, the year ended October 31, 2018 are listed on the “Important Notice Regarding the Availability2021 Annual Meeting of Proxy Materials.” These materials can also be viewed online by following the instructions listed on the “Important Notice Regarding the Availability of Proxy Materials.”

If you choose to receive a paper copy of our Proxy Statement and annual report, you may vote your shares by completing and returning the proxy card thatStockholders will be enclosed.virtual and will be held entirely online via live webcast at www.virtualshareholdermeeting.com/adxs2021. There will not be an option to attend the meeting in person.

Holders of record of the Company’s common stock at the close of business on December 26, 2018April 15, 2021 are entitled to receive notice of, and to vote at, the Annual Meeting. The date of mailing of this Notice of our 20192021 Annual Meeting of Stockholders and the accompanying Proxy Statement and materials is expected to be on or about January 15, 2019.April . 2021.

Important Notice Regarding the Availability of Proxy Materials

for our Annual Meeting of Stockholders to be held on JUNE 3, 2021.

All stockholders are cordially invited to attend the Annual Meeting. Regardless of whether you plan to attend the meeting virtually, we hope you will vote as soon as possible by following the instructions on your proxy card.

| By Order of the Board of Directors, | |

| /s/Kenneth A. Berlin | |

Kenneth A. Berlin | |

President and Chief Executive Officer, Interim Chief Financial Officer |

April , 2021

Princeton, New Jersey

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALSFOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON FEBRUARY 21, 2019.

THE PROXY STATEMENT AND ANNUAL REPORT ON FORM 10-K FORTHE FISCAL YEAR ENDED OCTOBER 31, 2018 ARE AVAILABLE AT HTTPS://WWW.PROXYVOTE.COM

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING AND INORDER TO ASSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUALMEETING, PLEASE SIGN AND RETURN THE ENCLOSED PROXY CARDAS PROMPTLY AS POSSIBLE IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE.

ADVAXIS, INC.

TABLE OF CONTENTS

PRELIMINARY PROXY STATEMENT

SUBJECT TO COMPLETION

DATED APRIL 2, 2021

Advaxis, Inc.305 College Road East9 Deer Park Drive, Suite K-1Princeton, New Jersey 08540Monmouth Junction, NJ 08852

PROXY STATEMENTANNUAL MEETING OF STOCKHOLDERSTO BE HELD ON FEBRUARY 21, 2019

ThisOur Board is providing these proxy statement is being made available via Internet access, beginning on or about January 11, 2019,materials to the owners of shares of common stock of Advaxis, Inc. (the “Company,“Company,” “our,“our,” “we,“we,” or “Advaxis”“Advaxis”) as of December 26, 2018,April 15, 2021, in connection with the solicitation of proxies by our Board of Directors (the “Board”“Board”) for our 20192021 Annual Meeting of Stockholders (the “Annual Meeting”“Annual Meeting”). On or about January 15, 2019,April , 2021, we expectintend to send an “Important Notice Regardingmail this proxy statement and the Availability of Proxy Materials” to our stockholders. If you received this notice by mail in prior years, you will not automatically receive by mail our Proxy Statement andaccompanying proxy card, together with the Company’s annual report to stockholders for the fiscal year ended October 31, 2018. If you would like2020, to receive a printed copy of our Proxy Statement, annual reporteach stockholder entitled to vote at the Annual Meeting.

Our Form 10-K/A for the fiscal year ended October 31, 2020, as well as this proxy statement, will be available through the Securities and proxy card, please follow the instructions for requesting such materials in the notice. Upon request, we will promptly mail you paper copies of such materials free of charge.Exchange Commission’s EDGAR system at http://www.sec.gov.

| 1 |

INFORMATION ABOUT THE ANNUAL MEETINGQUESTIONS AND ANSWERS

Why didam I receive an “Important Notice Regarding the Availability of Proxy Materials”?receiving these materials?

In accordance with SecuritiesWe sent this proxy statement and Exchange Commission (“SEC”) rules, instead of mailing a printed copy ofthe enclosed proxy card because the our Board is soliciting your proxy materials,to vote at the Annual Meeting and at any adjournment or postponement thereof. The Annual Meeting will be held on June 3, 2021 at virtually via live webcast at www.virtualshareholdermeeting.com/adxs2021. You are invited to virtually attend the Annual Meeting and we may send an “Important Notice Regardingrequest that you vote on the Availability of Proxy Materials”proposals described in this proxy statement. However, you do not need to stockholders. All stockholders will havevirtually attend the abilityAnnual Meeting to access the proxy materials on a website referred to in the notice or to request a printed set of these materials at no charge. You will not receive a printed copy of the proxy materials unless you specifically request one from us.vote your shares. Instead, the notice instructs you as to how you may accesssimply complete, sign and review all ofreturn the important information contained in theenclosed proxy materials via the Internet and submit your vote via the Internet.card, as discussed below.

When is the Annual Meeting?

The Annual Meeting will be held at 10:00 a.m., Eastern Time, on February 21, 2019.June 3, 2021.

Where will the Annual Meeting be held?

TheDue to concerns relating to the coronavirus (COVID-19) pandemic, and to support the health and well-being of our employees and shareholders, the 2021 Annual Meeting of Stockholders will be virtual and will be held entirely online via live webcast at www.virtualshareholdermeeting.com/adxs2021. There will not be an option to attend the offices of Goodwin Procter LLP, The New York Times Building, 26th Floor, 620 Eighth Avenue, New York, New York 10018.meeting in person.

What items will be voted on at the Annual Meeting?

There are sevensix matters scheduled for a vote:

| To elect six members to our Board | ||

| To approve an amendment to our Amended and Restated Certificate of Incorporation (the “Charter’) to increase the | ||

| To approve an amendment to | ||

To approve an | ||

To ratify and approve the prior amendment to the Company’s 2015 Incentive Plan, which was adopted following the 2020 Annual Meeting of Stockholders (the “2020 Annual Meeting”), to increase the total number of shares of common stock authorized for issuance thereunder from 877,744 shares to 6,000,000 shares (the “Plan Ratification Proposal”). | ||

| 6. | To ratify the | |

As of the date of this Proxy Statement, we are not aware of any other matters that will be presented for consideration at the Annual Meeting.

| 2 |

What are the Board of Directors’ recommendations?

Our Board recommends that you vote:

| ● | “FOR” the election of each of the | |

| ● | “FOR” the | |

| ● | “FOR” the | |

| ● | “FOR” the | |

| ● | “FOR” | |

| ● | ||

INFORMATION ABOUT THE VOTING

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on December 26,2018,April 15, 2021, which we refer to as the Record Date, are entitled to receive notice of the Annual Meeting and to vote the shares that they held on that date at the Annual Meeting, or any adjournment or postponement thereof. As of the close of business on the Record Date, we had 69,619,886 shares of common stock outstanding. Each share of common stock entitles its holder to one vote on each matter presented for a vote at the Annual Meeting.

| ● | Stockholders of | |

| ● | Beneficial |

What constitutes a quorum at the Annual Meeting?

In accordance with Delaware law (the law under which we are incorporated) and our Second Amended and Restated Bylaws,By-Laws (the “By-Laws”), the presence at the Annual Meeting, by proxy or in person, of the holders of at least one-third of the shares of our common stock outstanding on the record date constitutes a quorum, thereby permitting the stockholders to conduct business at the Annual Meeting. Abstentions, votes withheld, and broker non-votes will be included in the calculation of the number of shares considered present at the Annual Meeting for purposes of determining the existence of a quorum.

If a quorum is not present at the Annual Meeting, a majority in voting interest of the stockholders present in person andor represented by proxy may adjourn the meeting to another date. If an adjournment is for more than 30 days or a new record date is fixed for the adjourned meeting by our Board, of Directors, we will provide notice of the adjourned meeting to each stockholder of record entitled to vote at the adjourned meeting. At any adjourned meeting at which a quorum is present, any business may be transacted that might have been transacted at the originally called meeting.

| 3 |

What is a proxy?

A proxy is a person you appoint to vote your shares of our common stock on your behalf. If you are unable to attend the Annual Meeting, our Board of Directors is seeking your appointment of a proxy so that your shares of our common stock may be voted. If you vote by proxy, you will be designating Kenneth A. Berlin or Molly Henderson,(our President and Chief Executive Officer and Interim Chief Financial Officer) as your proxies.proxy. Mr. Berlin or Ms. Henderson may act on your behalf and havehas the authority to appoint a substitute to act as your proxy.

How do I vote?

Whether you hold shares directly as the stockholder of record or indirectly as the beneficial owner of shares held for you by a broker or other nominee (i.e., in “street name”), you may direct your vote without attending the Annual Meeting. You may vote by granting a proxy or, for shares you hold in street name, by submitting voting instructions to your broker or nominee. In most instances, you will be able to do this by internet, telephone or by mail. Please refer to the summary instructions below and those included on your proxy card or, for shares you hold in street name, the voting instruction card provided by your broker or nominee.

| ● | By Internet— If you have Internet access, you may authorize your proxy from any location in the world as directed | |

| ● | By Telephone— If you are calling from the United States or Canada, you may authorize your proxy by following the “By Telephone” instructions on the proxy card or, if applicable, the telephone voting instructions that may be described on the voting instruction card sent to you by your broker or nominee. | |

| ● | By Mail— You may authorize your proxy by signing your proxy card and mailing it in the enclosed, postage-prepaid and addressed envelope. For shares you hold in street name, you may sign the voting instruction card included by your broker or nominee and mail it in the envelope provided. |

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

Can I change my vote after I return my proxy card?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| ● | You may submit another properly completed proxy bearing a later date; | |

| ● | You may send a written notice that you are revoking your proxy to Advaxis, Inc. at | |

| ● | You may attend the Annual Meeting and |

If your shares are held by your broker, bank, custodian or other nominee, you should follow the instructions provided by such broker, bank, custodian or other nominee.nominee for revoking your proxy.

What if I sign and return my proxy but do not provide voting instructions?

Proxy cards or voting instruction cards that are signed, dated and returned but do not contain voting instructions will be voted:

| ● | “FOR” the election of each of the |

| 4 |

| ● | “FOR” the | |

| ● | “FOR” |

| ● | “FOR” the Annual Award Limit Proposal; | |

| ● | “FOR” the Plan Ratification Proposal; and | |

| ● | “FOR” the Auditor Ratification Proposal. |

How are votes counted?

Before the Annual Meeting, our Board will appoint one or more inspectors of election for the meeting. The inspector(s) will determine the number of shares represented at the meeting, the existence of a quorum and the validity and effect of proxies. The inspector(s) will also receive, count, and tabulate ballots andthe votes and determine the results of the voting on each matter that comes before the Annual Meeting.

Broker non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Under the rules of theapplicable New York Stock Exchange, Nasdaq Stock Exchange which govern voting matters at the Annual Meeting,(“Nasdaq”) and SEC rules, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner.

Under Nasdaqthese applicable rules, the following mattersAuthorized Shares Proposal, Stock Split Proposal and the Auditor Ratification Proposal are considered to be “routine” matters: (i) the approval of the amendment to the Advaxis, Inc. Amended and Restated Certificate of Incorporation for the purpose of increasing the authorized number of shares; (ii) the approval of the amendment to the Advaxis, Inc. Amended and Restated Certificate of Incorporation for the purpose of granting the Board of Directors authority to effect a reverse stock split and (iii) the ratification of Marcum LLP as our independent registered public accounting firm for the year ending October 31, 2018.matters. Brokers that hold your shares therefore have discretionary authority to vote your shares without receiving instructions from you on such matters.these matters, but not with respect to the other matters expected to be voted on at the Annual Meeting.

How many votes are needed to approve each proposal?

| ● | ||

| Director Election Proposal: To be | ||

| ● | ||

| ● | Stock Split Proposal: To be approved, the Stock Split Proposal must receive “FOR” votes from a majority of the shares entitled to vote thereon. Abstentions will have the same practical effect as a vote “AGAINST” the Stock Split Proposal. Broker discretionary voting is permitted with respect to the Stock Split Proposal. | |

| ● | Annual Award Limit Proposal: To be approved, Annual Award Limit Proposal must receive “FOR” votes from a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. If a quorum is present, broker non-votes will not affect the outcome of the vote on the Annual Award Limit Proposal, while abstentions will have the same practical effect as a vote “AGAINST” the Annual Award Limit Proposal. | |

| ● | Plan Ratification Proposal: To be approved, the Plan Ratification Proposal must receive “FOR” votes from a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. If a quorum is present, broker non-votes will not affect the outcome of the vote on the Plan Ratification Proposal, while abstentions will have the same practical effect as a vote “AGAINST” the Plan Ratification Proposal. |

| 5 |

| ● | Auditor Ratification Proposal: To be approved, the Auditor Ratification Proposal must receive “FOR” votes from a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. Abstentions will have the same practical effect as a vote “AGAINST” the Auditor Ratification Proposal. Broker discretionary voting is permitted with respect to the Auditor Ratification Proposal. |

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Form 8-K filed with the SEC, within four business days after the Annual Meeting.

How do I obtain a list of the Company’s stockholders?

A list of our stockholders as of the Record Date will be made available for virtual inspection at our corporate headquarters located at 305 College Road East, Princeton, New Jersey 08540upon request during normal business hours during the 10-day period prior to the Annual Meeting. To request a list of our stockholders as of the Record Date, please contact Igor Gitelman, our VP of Finance and Chief Accounting Officer, by telephone: 917-940-5651.

Who will solicit proxies on behalf of the Board?

Our Board is asking you to give your proxy to Kenneth A. Berlin, President and Chief Executive Officer and Interim Chief Financial Officer. Giving your proxy to Mr. Berlin means that you authorize Mr. Berlin, or his duly appointed substitute, to vote your shares at the Annual Meeting in accordance with your instructions. All valid proxies received prior to the Annual Meeting will be voted. All shares represented by a proxy will be voted, and where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the specification so made. If no choice is indicated on the proxy, then the shares will be voted in accordance with the Board’s recommendations.

Proxies may be solicited on behalf of the Board, without additional compensation, by the Company’s directors and certain executive officers or employees of the Company. Additionally, the Company has retained Morrow Sodali LLC, a proxy solicitation firm, to assist in the solicitation of proxies. Morrow Sodali LLC may solicit proxies on the Board’s behalf.

Who is paying for this proxy solicitation?

We will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to vote over the internet, you are responsible for internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by ourproxies. Our directors, officers and other employees, who will not receive anywithout additional compensation, for such solicitation activities. Proxies also may be solicitedsolicit proxies personally or in writing, by employees and our directors by mail, telephone, facsimile, e-mail, or otherwise. We are required to request that any brokers, trustees and other nominees who hold shares in person.

Additional Informationtheir names furnish our proxy materials to the beneficial owners of the shares, and we must reimburse these brokers, trustees and other nominees for the expenses of doing so in accordance with statutory fee schedules. We will pay Morrow Sodali LLC a fee not to exceed $8,000 plus costs and expenses.

Whom should I contact if I have any questions?

If you have any questions about the Annual Meeting, these proxy materials or your ownership of our common stock, please contact Molly Henderson,Igor Gitelman, our VP of Finance and Chief FinancialAccounting Officer, and Corporate Secretary, by mail at Advaxis, Inc., 305 College Road East, Princeton, New Jersey 08540,9 Deer Park Drive, Suite K-1, Monmouth Junction, NJ 08852, or by telephone: (609) 250-7510 or by fax: (609) 452-9818.917-940-5651.

| 6 |

PROPOSAL NO. 1

DIRECTOR ELECTION OF DIRECTORSPROPOSAL

Election of Directors

Our By-lawsBy-Laws provide that the number of directors is to be no less than one and no more than nine and shall be fixed by action of the directors. Currently, our Board of Directors consists of six members. Each director will hold office until the next annual meeting of stockholders and until his successor is duly elected and qualified, subject to his earlier resignation or removal. For information regarding the independence of our directors, see “Corporate Governance Matters — Director Independence” elsewhere in this Proxy Statement.

Unless otherwise instructed, the persons named in the proxy will vote to elect the six nominees named below as directors. Although the Board does not contemplate that any of the nominees will be unavailable to serve as a director, should any unexpected vacancies occur, the enclosed proxy will be voted for such substituted nominees, if any, as may be designated by the Board. In no event will the proxy be voted for more than six directors.

Information forabout the Nominees for Director

The namesfollowing nominees have been recommended by our Board. Each of the nominees for election as directors at the Annual Meeting, eachis one of whom is an incumbent director, and certain information about them, including their ages as of is set forth below:our current directors.:

| Name | Age | Position | ||

| Dr. David Sidransky | Chairman of our Board of Directors | |||

| Dr. James P. Patton | Vice Chairman of our Board of Directors | |||

| Roni A. Appel | Director | |||

| Kenneth | President and Chief Executive Officer, Interim Chief Financial Officer, Director | |||

| Richard J. Berman | Director | |||

| Dr. Samir | Director |

Biographical informationCurrent Directors

Dr. David Sidransky. Dr. Sidransky currently serves as the Chairman of our Board of Directors and has served as a member of our Board of Directors since July 2013. He is a renowned oncologist and research scientist named and profiled by TIME magazine in 2001 as one of the top physicians and scientists in America, recognized for all nominated directorshis work with early detection of cancer. Since 1994, Dr. Sidransky has been the Director of the Head and current directorsNeck Cancer Research Division and Professor of Oncology, Otolaryngology, Genetics, and Pathology at Johns Hopkins University School of Medicine. He has served as Chairman or Lead of the Board of Directors of Champions Oncology since October 2007 and was a director and Vice-Chairman of ImClone Systems until its merger with Eli Lilly Inc. He is providedthe Chairman of Tamir Biotechnology and Ayala and serves on the Board of Directors of Galmed and Orgenesis. He has served on scientific advisory boards of MedImmune, Roche, Amgen, and Veridex, LLC (a Johnson & Johnson diagnostic company), among others. Dr. Sidransky served as Director (2005-2008) of the American Association for Cancer Research (AACR). He earned his B.S. from Brandeis University and his Medical Doctorate from Baylor College of Medicine. Dr. Sidransky’s experience in the Corporate Governance Matters section elsewhere in this Proxy Statement.life science companies, as well as his scientific knowledge, qualify him to service as our director and non-executive chairman.

| 7 |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDSDr. James P. Patton. Dr. Patton currently serves as the Vice Chairman of our Board of Directors, has served as the Chairman of our Board and has been a member of our Board of Directors since February 2002. Furthermore, Dr. Patton was the Chairman of our Board of Directors from November 2004 until December 2005, as well as a period from July 2013 until May 2015, and was our Chief Executive Officer from February 2002 to November 2002. Since February 1999, Dr. Patton has been the Vice President of Millennium Oncology Management, Inc., which is a consulting company in the field of oncology services delivery. Dr. Patton was a trustee of Dundee Wealth US, a mutual fund family, from October 2006 through September 2014. He is a founder and has been chairman of VAL Health, LLC, a health care consultancy, from 2011 to the present. In addition, he was President of Comprehensive Oncology Care, LLC, a company that owned and operated a cancer treatment facility in Exton, Pennsylvania from 1999 until its sale in 2008. From February 1999 to September 2003, Dr. Patton also served as a consultant to LibertyView Equity Partners SBIC, LP, a venture capital fund based in Jersey City, New Jersey. From July 2000 to December 2002, Dr. Patton served as a director of Pinpoint Data Corp. From February 2000 to November 2000, Dr. Patton served as a director of Healthware Solutions. From June 2000 to June 2003, Dr. Patton served as a director of LifeStar Response. He earned his B.S. from the University of Michigan, his Medical Doctorate from Medical College of Pennsylvania, and his M.B.A. from Penn’s Wharton School. Dr. Patton was also a Robert Wood Johnson Foundation Clinical Scholar. He has published papers regarding scientific research in human genetics, diagnostic test performance and medical economic analysis. Dr. Patton’s experience as a trustee and consultant to funds that invest in life science companies provide him with the perspective from which we benefit. Additionally, Dr. Patton’s medical experience and service as a principal and director of other life science companies make Dr. Patton particularly qualified to serve as our director and non-executive vice chairman.

Roni A. Appel. Mr. Appel has served as a member of our Board of Directors since November 2004. He was our President and Chief Executive Officer from January 1, 2006 until December 2006 and Secretary and Chief Financial Officer from November 2004 to September 2006. From December 15, 2006 to December 2007, Mr. Appel served as a consultant to us. Mr. Appel currently is a self-employed consultant and the Co-Founder and President of Spirify Pharma Inc. Previously, he served as Chief Executive Officer of Anima Biotech Inc., from 2008 through January 31, 2013. From 1999 to 2004, he was a partner and managing director of LV Equity Partners (f/k/a LibertyView Equity Partners). From 1998 until 1999, he was a director of business development at Americana Financial Services, Inc. From 1994 to 1996, he worked as an attorney. Mr. Appel holds an M.B.A from Columbia University (1998) and an LL.B. from Haifa University (1994). Mr. Appel’s longstanding service with us and his entrepreneurial investment career in early stage biotech businesses qualify him to serve as our director.

Kenneth Berlin. Mr. Berlin has served as our President and Chief Executive Officer and a member of our Board of Directors since April 2018. Mr. Berlin has served as our Interim Chief Financial Officer since September 2020. Prior to joining Advaxis, Mr. Berlin served as President and Chief Executive Officer of Rosetta Genomics from November 2009 until April 2018. Prior to Rosetta Genomics, Mr. Berlin was Worldwide General Manager at cellular and molecular cancer diagnostics developer Veridex, LLC, a Johnson & Johnson company. At Veridex he grew the organization to over 100 employees, launched three cancer diagnostic products, led the acquisition of its cellular diagnostics partner, and delivered significant growth in sales as Veridex transitioned from an R&D entity to a commercial provider of oncology diagnostic products and services. Mr. Berlin joined Johnson & Johnson in 1994 and served as corporate counsel for six years. From 2001 until 2004 he served as Vice President, Licensing and New Business Development in the pharmaceuticals group, and from 2004 until 2007 served as Worldwide Vice President, Franchise Development, Ortho-Clinical Diagnostics. Mr. Berlin holds an A.B. degree from Princeton University and a J.D. from the University of California Los Angeles School of Law. Mr. Berlin’s experience in life science companies, as well as his business experience in general qualify him to service as our director.

Richard J. Berman. Mr. Berman has served as a member of our Board of Directors since September 1, 2005. Richard Berman’s business career spans over 35 years of venture capital, senior management and merger and acquisitions experience. In the past 5 years, Mr. Berman has served as a director and/or officer of over a dozen public and private companies. From 2006-2011, he was Chairman of National Investment Managers, a company with $12 billion in pension administration assets. Mr. Berman currently serves as a director of four public healthcare companies Cryoport Inc., Advaxis, Inc., BioVie, Inc. and BriaCell Therapeutics. Recently, he became a director of Comsovereign Holding Corp, a leader in the drone market. From 2002 to 2010, he was a director at Nexmed Inc. (now Apricus Biosciences, Inc.) where he also served as Chairman/CEO in 2008 and 2009. From 1998-2000, he was employed by Internet Commerce Corporation (now Easylink Services) as Chairman and CEO and served as director from 1998-2012. Previously, Mr. Berman worked at Goldman Sachs, was Senior Vice President of Bankers Trust Company, where he started the M&A and Leveraged Buyout Departments, created the largest battery company in the world in the 1980s by merging Prestolite, General Battery and Exide to form Exide Technologies (XIDE), helped to create what is now Soho (NYC) by developing five buildings, and advised on over $4 billion of M&A transactions (completed over 300 deals). He is a past Director of the Stern School of Business of NYU where he obtained his B.S. and M.B.A. He also has US and foreign law degrees from Boston College and The Hague Academy of International Law, respectively. Mr. Berman’s extensive knowledge of our industry, his role in the governance of publicly held companies and his directorships in other life science companies qualify him to serve as our director.

| 8 |

Dr. Samir Khleif. Dr. Khleif has served as a member of our Board of Directors since October 2014. He currently serves as the Director of the State of Georgia Cancer Center, Georgia Regents University Cancer Center and the Cancer Service Line. Dr. Khleif was formerly Chief of the Cancer Vaccine Section at the NCI, and also served as a Special Assistant to the Commissioner of the FDA leading the Critical Path Initiative for oncology. Dr. Khleif is a Georgia Research Alliance Distinguished Cancer Scientist and Clinician and holds a professorship in Medicine, Biochemistry and Molecular Biology, and Graduate Studies at Georgia Regents University. Dr. Khleif’s research program at Georgia Regents University Cancer Center focuses on understanding the mechanisms of cancer-induced immune suppression, and utilizing this knowledge for the development of novel immune therapeutics and vaccines against cancer. His research group designed and performed some of the first cancer vaccine clinical trials targeting specific genetic changes in cancer cells. He led many national efforts and committees on the development of biomarkers and integration of biomarkers in clinical trials, including the AACR-NCI-FDA Cancer Biomarker Collaborative and the ASCO Alternative Clinical Trial Design. Dr. Khleif is the author of many book chapters and scientific articles on tumor immunology and biomarkers process development, and he is the editor for two textbooks on cancer therapeutics, tumor immunology, and cancer vaccines. Dr. Khleif was inducted into the American Society for Clinical Investigation, received the National Cancer Institute’s Director Golden Star Award, the National Institutes of Health Award for Merit, the Commendation Medal of the US Public Health Service, and he was recently appointed to the Institute of Medicine National Cancer Policy Forum. Dr. Khleif’s distinguished career as well as his extensive expertise in vaccines and immunotherapies qualify him to serve as our director.

Director Independence

Each of our incumbent non-employee directors is independent in accordance with the definition set forth in the Nasdaq rules. Each nominated member of each of our Board committees is an independent director under the Nasdaq standards applicable to such committees. The Board considered the information included in transactions with related parties as outlined below along with other information the Board considered relevant, when considering the independence of each director.

Board Meetings and Committee Meetings; Attendance

All directors who served as directors at the time attended our 2020 Annual Meeting of Stockholders. Directors are expected, but not required, to attend the annual meeting of stockholders. We will encourage, but will not require, our directors to attend the Annual Meeting. Each director attended at least seventy-five percent (75%) of the aggregate of: (1) the total number of Board meetings; and (2) the total number of meetings of the committee(s) of which he was a member, if any. Our Board holds meetings at least quarterly. Our Board held 15 meetings during fiscal year 2020, 4 of which were regularly scheduled and 11 were special meetings.

Board Committees

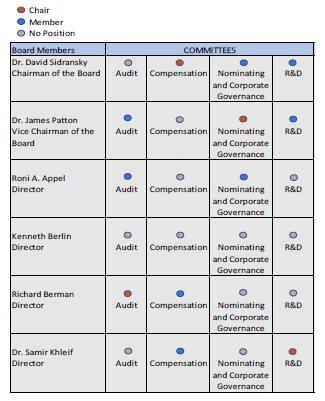

Presently, the Board has the following standing committees: Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and the Research and Development Committee. Each of the standing committees is comprised solely of independent directors.

| 9 |

The table below describes the Board’s committee membership during fiscal 2020:

Audit Committee

The Audit Committee of our Board of Directors is currently composed of Mr. Berman (Chairman), Mr. Appel and Dr. Patton, all of whom satisfy the independence and other standards for Audit Committee members under the Nasdaq rules and the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee is responsible for recommending the engagement of auditors to the full Board, reviewing the results of the audit engagement with the independent registered public accounting firm, reviewing the quality and integrity of our financial statements in consultation with our independent accountants, and suggesting an appropriate course of action for any irregularities, reviewing the adequacy, scope, and results of the internal accounting controls and procedures, reviewing the degree of independence of the auditors, as well as the nature and scope of our relationship with our independent registered public accounting firm, and reviewing the auditors’ fees. For fiscal year 2020, Mr. Berman served as the Audit Committee’s financial expert as defined under Item 407 of Regulation S-K. The Audit Committee held six meetings during the most recent fiscal year.

The Audit Committee operates under a written Audit Committee Charter, which is available to stockholders on our website at http://www.advaxis.com/corporate-governance/governance-overview.

| 10 |

Compensation Committee

The Compensation Committee of our Board of Directors currently consists of Mr. Berman, and Drs. Khleif and Sidransky (Chairman). The Compensation Committee determines the salaries, bonuses, and incentive and equity compensation of our officers subject to applicable employment agreements, provides recommendations for the salaries and incentive compensation of our other employees and consultants, and reviews and oversees our compensation programs and policies generally. For executives other than the Chief Executive Officer, the Compensation Committee receives and considers performance evaluations and compensation recommendations submitted to the Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which determines any adjustments to his compensation as well as awards to be granted. The agenda for meetings of the Compensation Committee is usually determined by its Chairman, with the assistance of the Company’s Chief Executive Officer. The Compensation Committee conducts at least five regularly scheduled meetings each year, which are regularly attended by the Chief Executive Officer. The Compensation Committee engaged AON Consulting, a compensation consultant, in September 2020, to perform a compensation program review and market analysis, as well as provide recommendations regarding adjustments to executive officer base salaries, target bonus opportunities and long-term equity incentives. The Compensation Committee held six meetings during the 2020 fiscal year.

The Compensation Committee operates under a written Compensation Committee Charter, which is available to stockholders on our website at https://www.advaxis.com/corporate-governance/governance-overview.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of our Board of Directors currently consists of Drs. Patton (Chairman), Appel and Sidransky. The functions of the Nominating and Corporate Governance Committee include identifying and recommending to the Board individuals qualified to serve as members of the Board and on the committees of the Board, advising the Board with respect to matters of board composition, procedures and committees, developing and recommending to the Board a set of corporate governance principles applicable to us and overseeing corporate governance matters generally including review of possible conflicts and transactions with persons affiliated with directors or members of management, and overseeing the annual evaluation of the Board and our management. The Nominating and Governance Committees held three meetings during the 2020 fiscal year.

The Nominating and Corporate Governance Committee operates under a written Nominating and Corporate Governance Committee Charter, which is available to stockholders on our website at https://www.advaxis.com/corporate-governance/governance-overview.

Nominating and Corporate Governance Committee will consider director candidates recommended by eligible stockholders. Stockholders may recommend director nominees for consideration by the Nominating and Corporate Governance Committee by writing to the Nominating and Corporate Governance Committee, Attention: Chairman, Advaxis, Inc., 9 Deer Park Drive, Suite K-1, Monmouth Junction, NJ 08852. Any recommendations for director made to the Nominating and Corporate Governance Committee should include the nominee’s name and qualifications for membership on our Board and must include the information required pursuant to the By-Laws with respect to the nominating stockholder and the director nominee.

The Company must receive the written nomination for an annual meeting not less than 90 days and not more than 120 days prior to the first anniversary of the previous year’s annual meeting of stockholders, or, if no annual meeting was held the previous year or the date of the annual meeting is advanced more than 30 days before or delayed more than 60 days after the anniversary date, we must receive the written nomination not later than the later of 90 days prior to such annual meeting or the close of business on the tenth day following the day on which public announcement of the date of such annual meeting is made by the Company.

The Nominating and Corporate Governance Committee expects, as minimum qualifications, that nominees to our Board of Directors (including incumbent directors) will enhance our Board of Director’s management, finance and/or scientific expertise, will not have a conflict of interest and will have a high ethical standard. A VOTEdirector nominee’s knowledge and/or experience in areas such as, but not limited to, the medical, biotechnology, or life sciences industry, equity and debt capital markets and financial accounting are likely to be considered both in relation to the individual’s qualification to serve on our Board of Directors and the needs of our Board of Directors as a whole. Other characteristics, including but not limited to, the director nominee’s material relationships with us, time availability, service on other boards of directors and their committees, or any other characteristics that may prove relevant at any given time as determined by the Nominating and Corporate Governance Committee shall be reviewed for purposes of determining a director nominee’s qualification.

| 11 |

Candidates for director nominees are evaluated by the Nominating and Corporate Governance Committee in the context of the current composition of our Board, our operating requirements and the long-term interests of our stockholders. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of our Board. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to us during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. The Nominating and Corporate Governance Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to our Board by majority vote. To date, the Nominating and Corporate Governance Committee has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates.

In identifying candidates for membership on the Board, the Nominating and Corporate Governance Committee takes into account all factors it considers appropriate and will seek to ensure that its membership consists of sufficiently diverse backgrounds, meaning a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. In considering candidates for the Board, the independent directors will consider, among other factors, diversity with respect to viewpoints, skills, experience and other demographics. In February 2020, the Nominating and Corporate Governance Committee instituted a policy whereby diversity, including diversity of gender, origin and background, became a key consideration when identifying candidates for membership on the Board. The Nominating and Corporate Governance Committee also may consider the extent to which the candidate would fill a present need on the Board.

Research and Development Committee

The Research and Development Committee was established in August 2013 with the purpose of providing advice and guidance to the Board on scientific and medical matters and development. The Research and Development Committee currently consists of Drs. Sidransky, Khleif (Chairman) and Patton. The functions of the Research and Development Committee include providing advice and guidance to the Board on scientific matters and providing advice and guidance to the Board on medical matters. The Research and Development Committee held did not hold any meetings during the 2020 fiscal year.

Board Leadership Structure

On May 27, 2015, David Sidransky was appointed Chairman and continues to serve as Chairman. Dr. Sidransky’s experience in life science companies, as well as his scientific knowledge, his history with our Company and his own history of innovation and strategic thinking, qualify him to serve as our Chairman. Additionally, on April 23, 2018, Kenneth Berlin was appointed President and Chief Executive Officer and named a member of the Board of Directors. Mr. Berlin’s knowledge of industry standards and his experience in industry operations, and his leadership experience complements Dr. Sidransky’s scientific knowledge.

While we do not have a formal policy regarding the separation of our principal executive officer and chairman of our Board, we believe the current structure is in the best interest of the Company at this time. Further, this structure demonstrates to our employees, customers and stockholders that we are under strong leadership, with multiple skills and sets the tone for managing our operations. This leadership structure promotes strategic development and execution, timely decision-making and effective management of our resources. We believe that we are well-served by this structure.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our employees, senior management and Board, including the Chief Executive Officer and Chief Accounting Officer. The Code of Business Conduct and Ethics is available on our website at http://www.advaxis.com/corporate-governance/governance-overview.

| 12 |

Risk Oversight

The Board has an active role in overseeing our risk management and is responsible for discussing with management and the independent auditors our major financial risk exposures, the guidelines and policies by which risk assessment and management is undertaken, and the steps management has taken to monitor and control risk exposure. The Board regularly engages in discussions of the most significant risks that we are facing and how those risks are being managed. The Board believes that its work and the work of the Chairman and the principal executive officer, enables the Board to effectively oversee our risk management function.

Stockholder Communications to the Board

Stockholders may contact an individual director, the Board as a group, or a specified Board committee or group, including the non-employee directors as a group, by writing to the following address:

Advaxis, Inc.

9 Deer Park Drive, Suite K-1

Monmouth Junction, NJ 08852

Attn: Board of Directors

Each communication should specify the applicable addressee or addressees to be contacted as well as the general topic of the communication. We will initially receive and process communications before forwarding them to the addressee. We generally will not forward to the directors a stockholder communication that we determine to be primarily commercial in nature or relates to an improper or irrelevant topic, or that requests general information about us.

Compensation Committee Interlocks and Insider Participation

Currently, the Compensation Committee consists of Mr. Berman and Drs. Khleif and Sidransky. No member of the Compensation Committee was an officer or employee of the Company during the last fiscal year, or had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K. No executive officer of the Company served as a member of the board of directors or compensation committee of another entity, one of whose executive officers served on the Company’s Compensation Committee or Board of Directors.

Certain Relationships and Related Transactions

Our policy is to enter into transactions with related parties on terms that, on the whole, are no more favorable, or no less favorable, than those available from unaffiliated third parties. Based on our experience in the business sectors in which we operate and the terms of our transactions with unaffiliated third parties, we believe that all transactions that we enter will meet this policy standard at the time they occur. Presently, we have no such related party transactions.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of our common stock by (a) each person who is known to us to be the owner of more than five percent (5%) of our common stock, (b) each of our directors, (c) each of the named executive officers, and (d) all directors and executive officers and executive employees as a group. For purposes of the table, a person or group of persons is deemed to have beneficial ownership of any shares that such person has the right to acquire within 60 days of March 29, 2021. The percentage of ownership is based on 120,382,668 shares outstanding as of March 29, 2021. Unless otherwise indicated by footnote, the address for each of the beneficial owners set forth in the table below is c/o Advaxis, Inc., 9 Deer Park Drive, Suite K-1, Monmouth Junction, NJ 08852.

| 13 |

| Name of Beneficial Owner | Total # of Shares Beneficially Owned | Percentage of Ownership | ||||||

| Kenneth Berlin (1) | 124,777 | * | % | |||||

| Igor Gitelman (2) | - | * | % | |||||

| David Sidransky (3) | 25,021 | * | % | |||||

| Roni Appel (4) | 29,170 | * | % | |||||

| Richard Berman (5) | 20,623 | * | % | |||||

| Samir Khleif (6) | 24,084 | * | % | |||||

| James Patton (7) | 36,389 | * | % | |||||

| Andres Gutierrez (8) | 50,973 | * | % | |||||

| All Current Directors and Officers as a Group (8 People) (9) | 305,481 | * | % | |||||

| Molly Henderson (10) | 5,833 | * | % | |||||

| Renaissance Technologies LLC (11) | 6,069,343 | 5.04 | % | |||||

*Less than 1%

(1) Represents 16,111 issued shares of our Common Stock, 5,555 restricted stock units that vest within 60 days, and options to purchase 103,111 shares of our Common Stock exercisable within 60 days.

(2) Mr. Gitelman’s options are not exercisable within 60 days.

(3) Represents 7,355 issued shares of our Common Stock and options to purchase 17,666 shares of our Common Stock exercisable within 60 days.

(4) Represents 10,476 issued shares of our Common Stock, options to purchase 16,805 shares of our Common Stock exercisable within 60 days and warrants to purchase 1,889 shares of our Common Stock exercisable within 60 days.

(5) Represents 3,711 issued shares of our Common Stock and options to purchase 16,912 shares of our Common Stock exercisable within 60 days.

(6) Represents 4,639 issued shares of our Common Stock and options to purchase 19,445 shares of our Common Stock exercisable within 60 days.

(7) Represents 19,117 issued shares of our Common Stock and options to purchase 17,272 shares of our Common Stock exercisable within 60 days.

(8) Represents 3,750 issued shares of our Common Stock and options to purchase 47,223 shares of our Common Stock exercisable within 60 days.

(9) Represents 70,715 issued shares of our Common Stock and options to purchase 238,434 shares of our Common Stock exercisable within 60 days and warrants to purchase 1,889 shares of our Common Stock exercisable within 60 days.

(10) Represents 5,833 issued shares of our Common Stock. Ms. Henderson resigned as the Company’s Chief Financial Officer effective September 25, 2020.

(11) Represents 6,069,343 issued shares of our Common Stock. The address for Renaissance Technologies LLC is 800 Third Avenue, New York, New York 10022. Information is derived in part from Schedule 13G/A filed on February 11, 2021.

Non-Employee Director Compensation

For fiscal year 2020, non-employee directors received an annual cash retainer of $50,000 for Board services, and the Chairman of the Board and the Vice Chairman of the Board received larger annual cash retainers of $80,000 and $65,000, respectively. Non-employee directors received additional annual retainers for serving on Board committees, as follows: $15,000 for Audit Committee Chair; $15,000 for Compensation Committee Chair; $7,500 for Audit Committee member; $7,500 for Compensation Committee member; $10,000 for Nominating and Corporate Governance Chair; $10,000 for Research and Development Chair; $5,000 for Nominating and Corporate Governance member; $5,000 for Research and Development member. On May 4, 2020, each non-employee director was granted 13,000 stock options. Of these options, one-third vest on May 4, 2021, one-third vest on May 4, 2022, and the final third will vest on May 4, 2023. The Compensation Committee annually reviews and makes recommendations to the Board regarding compensation and benefits for non-employee directors. As part of its annual review, the Compensation Committee regularly engages an independent compensation consultant to provide competitive market data and advice regarding non-employee director compensation.

| 14 |

The table below summarizes the compensation that was earned by our non-employee directors for fiscal year 2020:

| Name | Fees Earned or Paid in Cash ($) (1) | Option Awards ($) (2) | Total ($) | |||||||||

| Dr. David Sidransky | 105,000 | 6,760 | 111,760 | |||||||||

| Dr. James Patton | 87,500 | 6,760 | 94,260 | |||||||||

| Roni A. Appel | 62,500 | 6,760 | 69,260 | |||||||||

| Richard J. Berman | 72,500 | 6,760 | 79,260 | |||||||||

| Dr. Samir N. Khleif | 67,500 | 6,760 | 74,260 | |||||||||

| (1) | Represents the annual retainers paid in cash for director services in fiscal year 2020. | |

| (2) | Reflects the aggregate grant date fair value of stock options determined in accordance with FASB ASC Topic 718. The assumptions used in determining the grant date fair values of the stock options are set forth in Note 7 to the Company’s financial statements. |

Vote Required

To be elected under the Director Election Proposal, a director must receive “FOR” PROPOSAL NO. 1 RELATING TO ELECTING EACH OF THE FIVE NOMINEES LISTED ABOVE.votes from a majority of the votes cast by stockholders with respect to that director’s election. A director who fails to receive a majority of “FOR” votes will be required to tender his or her resignation to our Board. Our Nominating and Corporate Governance Committee will then assess whether there is a significant reason for such director to remain on our Board, and will make a recommendation to our Board regarding that director’s resignation. If a quorum is present, broker non-votes will not affect the outcome of the vote on the Director Election Proposal, while abstentions will have the same practical effect as a vote “AGAINST” the applicable nominee under the Director Election Proposal.

The Board of Directors unanimously recommends a vote “FOR” each of the director nominees under the Director Election Proposal.

| 15 |

PROPOSAL NO. 2APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO INCREASE THE TOTAL NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 95,000,000 TOPROPOSAL

Approval of an Amendment to the Charter to increase the number of authorized shares of common stock, $0.001 par value per share from 170,000,000

shares to 300,000,000 shares

Overview

Our Amended and Restated CertificateBoard has approved an amendment to our Charter, subject to stockholder approval, to increase the number of Incorporation (the “Certificate”) currently authorize us to issue an aggregate of 95,000,000authorized shares of common stock par value $0.001 per share,from 170,000,000 shares to 300,000,000 shares, and 5,000,000recommends unanimously that our stockholders approve the Authorized Shares Proposal. The text of the proposed amendment is attached hereto as Appendix A (the “Charter Amendment”). You are encouraged to read the Charter Amendment and our Charter, which is available as Exhibit 3.1 to our Annual Report on Form 10-K/A for the year ended October 31, 2020, carefully in their entirety.

The additional 130,000,000 shares of “blank check” preferredcommon stock par value $0.001 per share.will be part of the existing class of common stock, and, if and when issued, would have the same rights and privileges as the shares of common stock presently issued and outstanding. The Authorized Shares Proposal is not contingent on the approval of any other proposal to be considered at the Annual Meeting (including, for the avoidance of doubt, the Stock Split Proposal).

The Company previously amended and restated its charter to increase the number of authorized shares of common stock from 95,000,000 to 170,000,000 following approval by the Company’s stockholders at the 2019 Annual Meeting of Stockholders held on February 21, 2019.

Purpose

Our Board believes that the authorized number of Directors has approved,shares of common stock should be increased as a matter of good corporate governance to provide sufficient shares for such corporate purposes as may reasonably be determined by the Board to be necessary and is seekingin the best interest of the Company and its stockholders. These purposes may include, but are not limited to:

| ● | expanding our business through the acquisition of other businesses, products or assets; | |

| ● | establishing partnerships and strategic relationships with other companies; | |

| ● | raising capital through the future sale of our common stock when necessary or appropriate; and | |

| ● | attracting and retaining valuable employees by providing shares available for equity incentives. |

Our Board believes that these additional shares would provide us with needed flexibility to issue shares in the future without potential expense or delay incident to obtaining stockholder approval for a particular issuance. Currently, we do not have any specific plans, arrangements, undertakings or agreements for the proposed increase of an amendmentauthorized shares in connection with any of the foregoing prospective activities. Once authorized, the additional shares of common stock may be issued with approval of our Board but without further approval from our stockholders, unless applicable law, rule or regulation requires stockholder approval for such issuance. Stockholder approval of the Authorized Shares Proposal is required under Delaware law.

Proposed Changes to our Certificate (the “Amendment”) tothe Charter

The proposed Authorized Shares Proposal will increase the number of shares of common stock authorized for issuance by 75,000,000from 170,000,000 shares bringingto 300,000,000 shares. Before giving effect to any changes following approval of the total number ofAuthorized Shares Proposal, the Company is currently authorized to issue 175,000,000 shares of capital stock, of which 170,000,000 shares are designated as common stock to 170,000,000 shares.and 5,000,000 shares are designated as preferred stock, $0.001 par value per share (“preferred stock”) (none of which are currently issued and outstanding). The textAuthorized Shares Proposal will not change any substantive terms of the proposedCompany’s common stock or preferred stock or any powers or rights of their respective holders. The Company’s common stock will continue to be listed and traded on the Nasdaq under the symbol “ADXS.”

| 16 |

If the Authorized Shares Proposal is approved, we intend to amend the Charter in connection with implementing the proposal. A copy of the Charter Amendment is attached heretoto this proxy statement asExhibit A. Appendix A.

Certain Risks Associated with the Authorized Shares Proposal

No changesThere can be no assurance that the market price per share of our common stock after the Authorized Shares Proposal will remain constant in proportion to the Certificate are being proposed with respect to the number of authorized shares of preferred stock. Other than the proposed increase in the number of authorized shares of our common stock outstanding before the Authorized Shares Proposal.

The market price of our common stock will also be based on our performance and other factors, some of which are unrelated to the number of shares outstanding. These factors include the status of the market for our common stock, our reported results of operations in future periods, and general economic, market and industry conditions.

Principal Effects on Outstanding Common Stock

Holders of common stock are entitled to one vote per share on all matters submitted to a vote of stockholders. Upon a liquidation, dissolution or windup of the Amendment is not intendedCompany, holders of common stock would be entitled to modifyshare ratably in any assets for distribution to stockholders after payment of all of the Company’s obligations, subject to the rights to receive preferential distributions of existing stockholders inthe holders of any material respect. preferred stock then outstanding.

The additional shares of common stock to be authorized pursuant to the Amendment would have rights identical to the currently outstandingour common stock currently outstanding. Approval of the Company. Our stockholders do not currently haveAuthorized Shares Proposal and any preemptive or similar rights to subscribe for or purchase any additional sharesissuance of common stock that may be issued inwould not affect the future, and therefore,rights of the holders of our common stock currently outstanding, except to the extent that future issuances of common stock may, depending onwould reduce each existing stockholder’s proportionate ownership. If the circumstances, have a dilutive effect onproposed Authorized Shares Proposal is approved and the earnings per share, voting power and other interestsBoard decides to issue such shares of the existing stockholders.

The Boardcommon stock, such issuance of Directors has unanimously determined that the Amendment is advisable and in the best interests of the Company and our stockholders, and recommends that our stockholders approve the Amendment.

Reasons for Increase

The Board of Directors believes that it is prudent tocommon stock would increase the authorizedoutstanding number of shares of common stock, thereby causing dilution in orderearnings per share and voting interests of the outstanding common stock. As of the Record Date, shares of our common stock were issued and outstanding and shares of our common stock were subject to maintain a reserveoutstanding stock options, warrants or other convertible securities, thereby leaving shares of common stock unassigned and authorized for potential issuance of the current 170,000,000 shares of common stock authorized. If the Authorized Shares Proposal is approved, there will be shares of common stock unassigned and authorized for potential issuance. If approved, the Authorized Shares Proposal will not change the number of shares availableof preferred stock authorized for immediateissuance.

The following table sets forth the potential dilutive effect on the beneficial ownership of the existing stockholders of the Company if all of the shares of common stock authorized were issued by the Company:

| Beneficial Ownership of Existing Stockholders before the Authorized Shares Proposal | Beneficial Ownership of Existing Stockholders after the Authorized Shares Proposal | |||||||||||||||

| Number | Percentage | Number | Percentage | |||||||||||||

| Existing Stockholders (1)(2) | % | % | ||||||||||||||

(1) For purposes of clarification, the percentage represented by the existing stockholders excludes any and all options, warrants and other convertible securities held by the existing stockholders.

(2) Ownership is based upon the number of outstanding shares of common stock as of the Record Date, and assumes the issuance to meet business needs, such as a strategic acquisition opportunity or equity offerings, promptly as they arise. The Board of Directors believes that maintaining such a reserve will save time and money in responding to future events requiringall authorized but unissued shares of common stock before the proposed amendment.

| 17 |

Additionally, the issuance of additional shares of common stock such as strategic acquisitionscould have the effect of making it more difficult for a third party to acquire, or future equity offerings.

All authorized but unissueddiscouraging a third party from attempting to acquire, control of the Company. While the issuance of additional shares of common stock willmay be available for issuance from timedeemed to time for any proper purpose approvedhave potential anti-takeover effects, including by delaying or preventing a change in control of the BoardCompany through subsequent issuances of Directors (includingthese shares and the other reasons set forth above, which among other things, could include issuances in connection with issuances to raise capital, effect acquisitionsone or stock-based employee benefit plans), without further votemore transactions that would make a change in control of the Company more difficult, and therefore, less likely, this proposal to increase the authorized common stock is not prompted by any specific effort of which we are aware to accumulate shares of our common stock or obtain control of the Company. A takeover may be beneficial to independent stockholders exceptbecause, among other reasons, a potential suitor may offer such stockholders a premium for their shares of common stock as required under applicable law orcompared to the Nasdaq Marketplace Rules. There are currently no arrangements, agreements or understandings forthen-existing market price. Although the issuance of the additional shares of authorized common stock except for issuancescould, under certain circumstances, have an anti-takeover effect, this proposal to adopt Authorized Shares Proposal is not in response to any attempt to accumulate common stock or obtain control of the Company that we are aware of, nor is it part of a plan by management to recommend a series of similar amendments to the Board or stockholders.

Interests of Certain Persons in the ordinary courseProposal

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this Authorized Shares Proposal, except to the extent of business. their ownership in shares of our common stock and securities convertible or exercisable for common stock.

Vote Required

Approval of the Authorized Shares Proposal requires the affirmative vote of a majority of the Company’s outstanding stock entitled to vote thereon. Abstentions will have the same practical effect as a vote “AGAINST” the Authorized Shares Proposal. Broker discretionary voting is permitted with respect to the Authorized Shares Proposal.

The Board of Directors does not presently intend to seek further stockholder approval of any particular issuance of shares unless such approval is required by law orunanimously recommends a vote “FOR” the Nasdaq Marketplace Rules.Authorized Shares Proposal.

| 18 |

If the Proposed Amendment is approved by the stockholders, it will become effective upon filing and recording of a Certificate of Amendment as required by the Delaware General Corporation Law.

Vote Required

To approve Proposal No. 2, stockholders holdingApproval of an Amendment to the Charter to effect a majorityreverse stock split of our common stock at a ratio to be determined by the Board within a specified range of one-for-five to one-for-fifteen, without reducing the authorized number of shares of our common stock, to be effected in the sole discretion of the outstanding sharesBoard at any time within one year of Advaxis common stock must vote FOR Proposal No. 2. “Broker non-votes” shall be counted as votes FOR Proposal No. 2, while abstentions will count as a vote AGAINST Proposal No. 2.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” PROPOSAL NO. 2 RELATING TO THE AMENDMENT OF OUR AMENDED

AND RESTATED CERTIFICATE OF INCORPORATION TO INCREASE OUR

AUTHORIZED SHARES OF COMMON STOCK BY 75,000,000 SHARES

FROM 95,000,000 TO 170,000,000.

PROPOSAL NO. 3APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR COMMON STOCK AT A RATIO DETERMINED BY THE BOARD OF DIRECTORS WITHIN A SPECIFIED RANGE, WITHOUT REDUCING THE AUTHORIZED NUMBER OF SHARES OF OUR COMMON STOCK, TO BE EFFECTED IN THE SOLE DISCRETION OF THE BOARD OF DIRECTORS AT ANY TIME WITHIN ONE YEAR OF THE DATE OF THE ANNUAL MEETING WITHOUT FURTHER APPROVAL OR AUTHORIZATION OF OUR STOCKHOLDERSthe date of the Annual Meeting without further approval or authorization of our stockholders

Overview

The Board has adopted a resolution approving and recommending to the Company’s stockholders for their approval a proposal to amend our certificate of incorporationCharter to effect a reverse split of our outstanding shares of common stock within a range of one share of common stock for every tenfive shares (1-for-10)(1-for-5) of common stock to one share of common stock for every twenty-fivefifteen shares (1-for-25)(1-for-15) of common stock, with the exact reverse split ratio to be decided and publicly announced by the Board prior to the effective time of the amendment to our Amended and Restated Certificate of IncorporationCharter to effect the reverse stock split (the “Reverse“Reverse Stock Split Amendment”Amendment”). If the stockholders approve this Stock Split Proposal, No. 3, the Board will have the authority to decide, at any time prior towithin one year of the date of our 2020this Annual Meeting, of Stockholders (the “2020 Annual Meeting”), whether to implement the reverse stock split and the precise ratio of the reverse stock split within a range of one-for-tenone-for-five shares of our common stock to one-for-twenty-fiveone-for-fifteen shares of our common stock. If the Board decides to implement the reverse stock split, the reverse stock split will become effective upon the filing of the Reverse Stock Split Amendment with the Secretary of State of the State of Delaware.

The Board reserves the right, even after stockholder approval, to abandon or postpone the filing of the Reverse Stock Split Amendment if the Board determines that it is not in the best interests of the Company and the stockholders. If the Reverse Stock Split Amendment is not implemented by the Board prior towithin one year of the date of the 2020this Annual Meeting, the proposal will be deemed abandoned, without any further effect. In that case, the Board may again seek stockholder approval at a future date for a reverse stock split if it deems a reverse stock split to be advisable at that time. The Stock Split Proposal is not contingent on the approval of any other proposal to be considered at the Annual Meeting (including, for the avoidance of doubt, the Authorized Shares Proposal).

Reasons for the Reverse Stock Split

The primary reason for the reverse stock split is to allow us to attempt to increase the bid price of our common stock by reducing the number of outstanding shares of our common stock. To continue listing on The Nasdaq GlobalCapital Market, we must comply with the applicable listing requirements under Nasdaq Marketplace Rules, which requirements include, among others, a minimum bid price of at least $1.00 per share. On December 10, 2018,October 30, 2020, the closing bid price of our common stock on the Nasdaq Global Market was $0.37. The Board believes that the reverse stock split will enhance the Company’s ability to maintain compliance with the applicable listing requirements under Nasdaq Marketplace Rules.$0.3380.

If we were unable to maintain compliance with the $1.00 minimum bid price requirement and our common stock were delisted from Nasdaq, trading of our common stock would most likely take place on an over-the-counter market established for unlisted securities, such as the Pink Sheets or the OTC Bulletin Board. An investor would likely find it less convenient to sell, or to obtain accurate quotations in seeking to buy, our common stock on an over-the-counter market, and many investors would likely not buy or sell our common stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange or other reasons. In addition, as a delisted security, our common stock would be subject to SEC rules regarding “penny stock,” which impose additional disclosure requirements on broker-dealers. The regulations relating to penny stocks, coupled with the typically higher cost per trade to the investor of penny stocks due to factors such as broker commissions generally representing a higher percentage of the price of a penny stock than of a higher-priced stock, would further limit the ability of investors to trade in our common stock. For these reasons and others, delisting from the Nasdaq Capital Market would adversely affect the liquidity, trading volume and price of our common stock, causing the value of an investment in us to decrease and having an adverse effect on our business, financial condition and results of operations, including our ability to attract and retain qualified employees and to raise capital.

| 19 |

In addition, among the factors considered by the Board in reaching its decision to recommend the reverse stock split, the Board considered the potential effects of having stock that trades at a low price. Since the brokerage commissions on stock with a low trading price generally represent a higher percentage of the stock price than commissions on higher priced stock, investors in stocks with a low trading price pay transaction costs (commissions, markups, or markdowns) at a higher percentage of their total share value, which may limit the willingness of individual investors and institutions to purchase our common stock.

There will be no change in our authorized shares as a result of the Reverse Stock Split Amendment and therefore, upon effectiveness of the reverse stock split, the number of shares of our common stock that are authorized and unissued will increase relative to the number of issued and outstanding shares. Except as discussed below under the heading “Principal Effects of the Reverse Stock Split,” we currently have no plans, proposals, arrangements or understandings to issue any of our authorized but unissued shares of our common stock. However, it is possible that some of these additional authorized shares could be used in the future for various other purposes without further stockholder approval, except as such approval may be required in particular cases by our certificate of incorporation, applicable law or the rules of any stock exchange or other system on which our securities may then be listed.

Certain Risks Associated with the Reverse Stock Split

Certain risks associated with the implementation of the reverse stock split include, without limitation, the following:

| ● | While the Board believes that a higher share price may help generate investor interest, there can be no assurance that a reverse stock split will result in a share price that will attract institutional investors or investment funds or satisfy the investing guidelines of such investors. | |

| ● | Some investors may view the reverse stock split negatively, and there can be no assurance that the reverse stock split will favorably impact the share price of our common stock or that the reverse stock split will not adversely impact the share price of our common stock. | |